How to register for customs declaration service

The UK will start to use the CDS (customs declaration service) system for declaration on October 1, 2022. The import declaration system CHIEF will be closed on September 30, 2022, and the export declaration service will be closed on March 31, 2023. Before this, the CHIEF system and CDS (customs declaration service) of the UK customs clearance system can be declared.

Get the CDS account registration on the UK government website and follow the process to register.

Notice: Before obtaining the CDS account, the seller friend must confirm that he has the Gateway ID of the British government. The Gateway ID is required when registering the British EORI number.

Why should I register for a CDS account?

- It is convenient to query customs clearance information and download documents. Sellers can directly download the import VAT deferred records and C79 documents in the CDS account (if the import is deferred, there will be no C79 documents, because the deferred import VAT does not need to be paid)

- If you do not register a CDS account, it may affect customs clearance or cannot be deferred.

What are the changes to the filing documents using the CDS system?

● CHIEF system declaration will have C88 and E2 documents (i.e. import tax documents, generally referred to as C88 documents), while CDS system only has CDS entry documents (i.e. CDS system tax documents)

● After the declaration, the seller can download the CDS system tax bill directly from the CDS account (the customs clearance agent can also provide the tax bill);

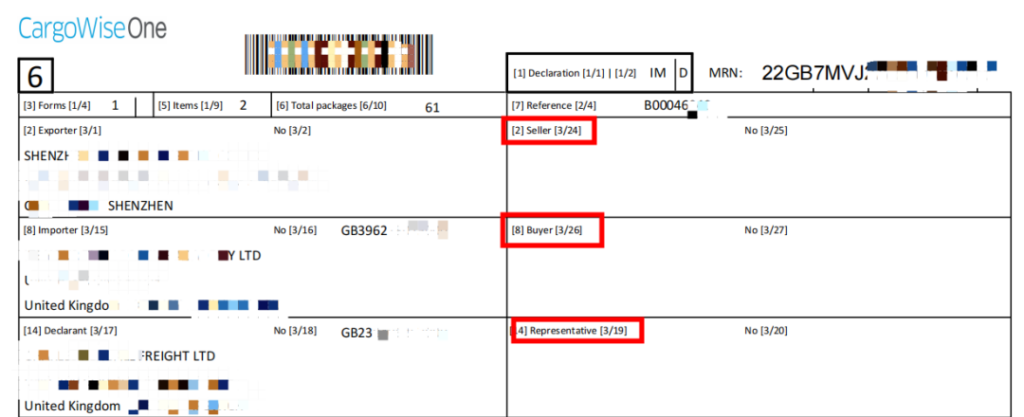

● The content of the CDS tax bill is divided into 8 categories of information instead of the previous 54 information boxes. The CDS system tax bill contains the following eight categories of information:

- Data (1/1,1/2…) represents declaration information

- References to documents, certificates, authorizations

- Identity information of importers and exporters, declarers, etc.

- Valuation method and tax calculation method

- The origin of the goods, the date and place of the declaration, etc.

- Product Details

- Shipping Information

- Other information

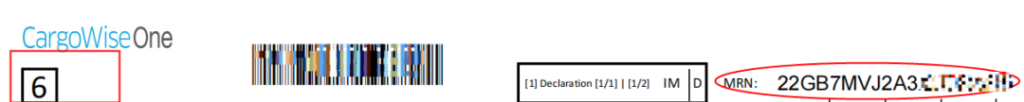

● The name of the Entry is changed to MRN, and the content is composed of 18 digits and letters. Sellers should pay attention to the “import entry” filled in in the Amazon backstage in the future, which needs to be changed from the Entry number to the MRN number.

● Newly added: “Seller”, “Buyer”, “Representative” declaration information on the tax bill of the CDS system, but the UK Customs has not yet mandated declaration

How to pay taxes in CDS system

- Recharge a certain amount in the cash account of the CDS account, and pay with the balance of the cash account;

- Recharge a certain amount in the duty deferment account and settle the tax every month;

- Real-time payment, payment through online bank transfer;

- Jiufang E-commerce Logistics pays taxes on behalf of them;

For more information: Customs Declaration Service – GOV.UK