CMA CGM's 2021 net profit is about $17.9 billion

On March 5, CMA CGM announced its 2021 results.

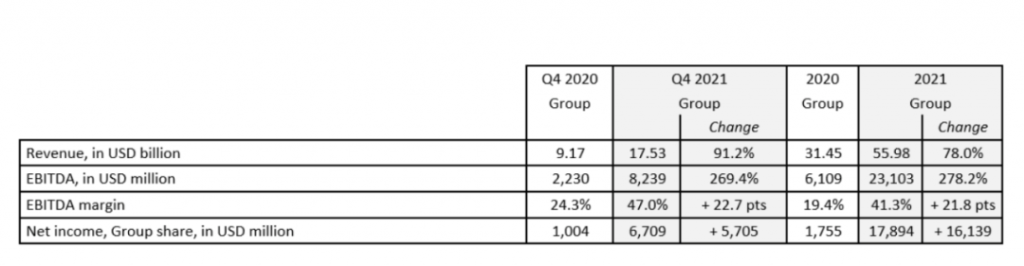

Operating income reached approximately US$55.98 billion, a year-on-year increase of 78%; earnings before interest, tax, depreciation and amortization (EBITDA) reached US$23.1 billion, a year-on-year increase of 278.2%; net profit was US$17.894 billion, compared with US$1.755 billion in the same period last year, a year-on-year increase 919.6%. Profitability in all business segments improved.

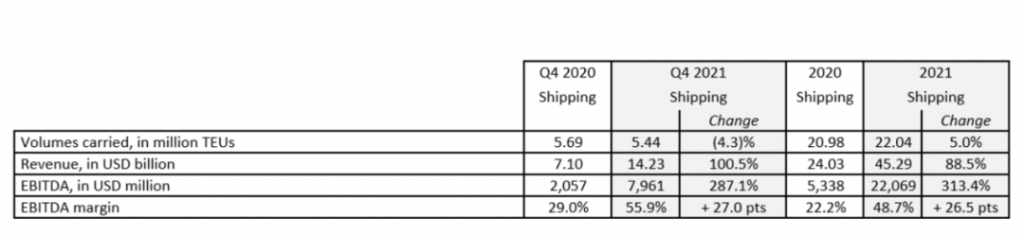

In terms of business segments, the operating revenue of the shipping segment in 2021 will be approximately US$45.3 billion, a year-on-year increase of 88.5%; EBITDA will be US$22.1 billion, a year-on-year increase of 313.4%; cargo volume will be 22 million TEU, a year-on-year increase of 5%.

CMA CGM said that the growth of the shipping business was mainly due to the increase in freight rates.

Its average revenue per box was 2,055/TEU, compared with 1,154/TEU in the same period last year, a year-on-year increase of 78%. Regarding the increase in freight rates in 2021, CMA CGM said that it is related to the sharp rise in operating costs including energy, handling and charter costs. Among them, in the fourth quarter of 2021, the cost of a single container increased by nearly 30% year-on-year.

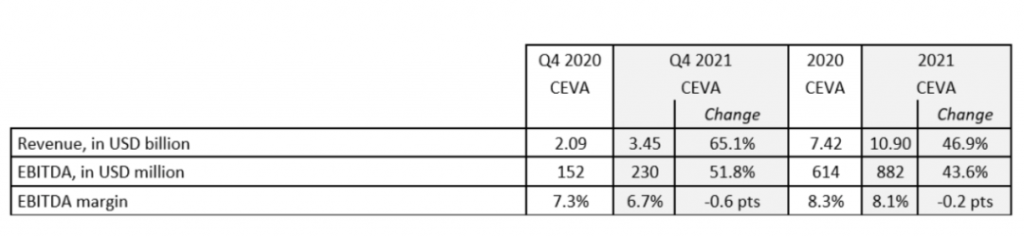

In addition, the logistics segment’s operating income in 2021 will be US$10.9 billion, a year-on-year increase of 46.9%; EBITDA will reach US$882 million, a year-on-year increase of 43.6%.

CMA CGM said that the growth of the logistics segment was mainly driven by the sea and air freight business, as well as the recovery of the contract logistics business. At the same time, the performance of CEVA Logistics, a subsidiary of CMA CGM Group, improved.

Regarding the performance, Rodolphe Saadé, Chairman and CEO of CMA CGM Group, commented: “Driven by extremely strong transportation demand, we have achieved excellent results in 2021. At the same time, we have accelerated the Group’s development through strategic acquisitions. “

Rodolphe Saadé further stated that the continued tension in the global supply chain is challenging for small and medium-sized enterprises. In view of this, CMA CGM decided to allocate dedicated transportation capacity for small and medium-sized enterprises in the European and North American markets with tight transportation capacity at the negotiated price.

In addition, CMA CGM also announced a new freeze period for spot freight rates until June 30, 2022, the first shipping company to implement this move.

Looking forward to 2022, CMA CGM said that the current global trade is developing healthily, but there are still geopolitical uncertainties. As tensions in the global supply chain continue to put pressure on effective capacity and company operations, CMA CGM will further increase its fleet capacity and plan to allocate nearly US$9 billion to strengthen its asset portfolio (including the purchase and lease of containers and container ships) , excluding acquisitions).